Posted By Christina Bell, CPA

In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2016-14 (ASU 2016-14) to make improvements to the communication of information on not-for-profit financial statements. ASU 2016-14 is effective for not-for-profit organizations with annual reporting periods beginning after December 15, 2017 (calendar year 2018 or fiscal year 2019). ASU 2016-14 focuses on the five main areas listed below, but this blog will provide information and implementation examples solely related to functional expense reporting. Functional expense reporting, when done accurately and consistently, can provide a realistic picture of the total cost of operating an organization. Too much program expense may mean an organization is under-investing in technology, personnel development, or strategic planning. Too little program expense may mean an organization is not being as efficient as it should be with its received resources. Understanding this can help an organization increase efficiency and distribute resources in a manner that maximizes programmatic effort while maintaining a justified level of supporting services.

In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2016-14 (ASU 2016-14) to make improvements to the communication of information on not-for-profit financial statements. ASU 2016-14 is effective for not-for-profit organizations with annual reporting periods beginning after December 15, 2017 (calendar year 2018 or fiscal year 2019). ASU 2016-14 focuses on the five main areas listed below, but this blog will provide information and implementation examples solely related to functional expense reporting. Functional expense reporting, when done accurately and consistently, can provide a realistic picture of the total cost of operating an organization. Too much program expense may mean an organization is under-investing in technology, personnel development, or strategic planning. Too little program expense may mean an organization is not being as efficient as it should be with its received resources. Understanding this can help an organization increase efficiency and distribute resources in a manner that maximizes programmatic effort while maintaining a justified level of supporting services.

Five main areas of focus in ASU 2016-14:

- Net asset classes

- Investment return

- Functional expense reporting

- Liquidity and availability of resources

- Presentation of operating cash flows

ASU 2016-14 requires all organizations to present an analysis of expenses by function and nature in one location, which could be on the face of the statement of activities, as a separate statement, or in the notes to the financial statements. Prior to ASU 2016-14, only voluntary health and welfare organizations had to report expenses by nature and function. While reporting expenses by nature is not difficult, reporting expenses by function can be more challenging. Reporting expenses by function requires each expense to be allocated between program services and supporting activities. Below are some helpful definitions from FASB:

- Program services – activities that result in goods and services being distributed to beneficiaries, customers, or members that fulfill the purposes or mission for which the not-for-profit organization exists.

- Supporting activities – all activities of a not-for-profit organization other than program services. Generally, they include management and general activities, fundraising activities, and membership development activities.

- Management and general activities – activities that are not identifiable with a single program, fundraising activity, or membership development activity but that are indispensable to the conduct of those activities and to an organization’s existence. FASB provides the following examples: oversight, business management, general record keeping, budgeting, financing, annual report production and distribution, soliciting funds other than contributions and membership dues, and all management and administration except for direct conduct of program services or fundraising activities.

- Fundraising activities – activities undertaken to induce potential donors to contribute money, securities, services, materials, facilities, other assets, or time. FASB provides the following examples: conducting fundraising campaigns, maintaining donor mailing lists, conducting special fundraising events, preparing and distributing fundraising manuals, instructions, and other materials, and other activities involved with soliciting contributions.

- Membership development activities – activities that include soliciting for prospective members and membership dues, membership relations, and similar activities. FASB indicates that if no significant benefits are provided to members in exchange for their payment of membership dues, the substance of the membership development activities is considered fundraising for the purpose of functional classification reporting.

The FASB stresses, via their examples, that in order for an expense to be allocated to program services, the expense must be the result of direct conduct and/or direct supervision of a program activity and that the expense must be allocated to the program or support function(s) that receive(s) the direct benefit. Any expense that has a benefit to the organization as a whole automatically falls into the supporting activities function. What this means, for example, is that time spent by the accounting staff administering government, foundation and similar customer-sponsored contracts, including billing and collecting fees and grants and contract financial reporting, is a supporting activity, not a program service. While these reports are critical to the success of the grant, they are not part of the direct conduct/supervision of the grant.

Organizations need to identify what expenses are allocable between functions and develop allocation polices for these expenses. Allocation policies are required to be disclosed in the organization’s financial statements under ASU 2016-14.

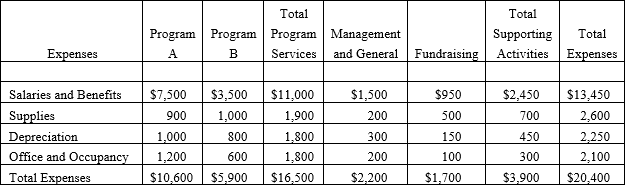

The following is an example of reporting expenses by function and nature in one location:

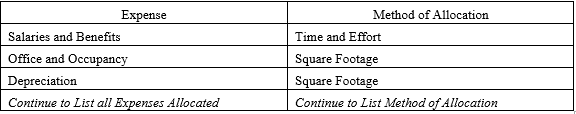

The following are two examples for disclosing allocation policies utilized in allocating expenses between program services and supporting activities:

- The financial statements report certain categories of expenses that are attributable to one or more program or supporting functions of the organization. Those expenses include depreciation, salaries and benefits, and office and occupancy costs. Depreciation and office and occupancy costs are allocated on a square footage basis. Salaries and benefits are allocated on the basis of estimates of time and effort.

- The costs of providing various programs and other activities have been summarized on a functional basis in the statements of activities and in the statements of functional expenses. Accordingly, certain costs have been allocated among the programs and supporting services benefited. Such allocations are determined by management on a reasonable basis that is consistently applied.

The expenses that are allocated include the following:

This blog covered one of the five main ares of focus in ASU 2016-14, stay tuned for additional blogs that cover the remaining four ares of focus. Please contact your CPA or BLS professional with any questions or to request additional guidance regarding ASU 2016-14.

*All blog posts are valid as of the date published.

Photo by (Jim Maes) License