Posted by Casey Hagy, CPA

On June 21, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-08: Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. The issuance of this ASU is in response to the difficulty and diversity in the practice of distinguishing between exchange transactions (reciprocal) and contributions (nonreciprocal), as well as distinguishing between conditional and unconditional contributions. Although accounting for contributions is primarily an issue for not-for-profit organizations, this ASU applies to all entities (not-for-profit organizations and business entities) that receive or make contributions unless otherwise indicated.

On June 21, 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-08: Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. The issuance of this ASU is in response to the difficulty and diversity in the practice of distinguishing between exchange transactions (reciprocal) and contributions (nonreciprocal), as well as distinguishing between conditional and unconditional contributions. Although accounting for contributions is primarily an issue for not-for-profit organizations, this ASU applies to all entities (not-for-profit organizations and business entities) that receive or make contributions unless otherwise indicated.

Determining Contributions from Exchange Transactions

This determination is crucial because it will decide the type of accounting guidance that should be applied. For contributions, organizations should follow the guidance in Subtopic 958-605. For exchange transactions, organization should follow other guidance (for example, Topic 606, Revenue from Contracts with Customers). The first decision to consider is whether the resource provider is receiving commensurate value in return for the resources being transferred to the not-for-profit organization; or simply put, “who receives the benefit?” of the transaction. It is important to note that the resource provider (even a governmental agency) is not synonymous with the general public. Societal benefit, even if it furthers the resource provider’s mission, is not equivalent to commensurate value received by the resource provider. Additionally, the type of resource provider should not factor into this determination. Contribution revenue can be classified in the financial statements using a variety of terms (gifts, grants, donations, etc.). The specific term used does not exclude the revenue from going through this determination.

ASU 2018-08 provides the following guidance to assist in the evaluation of contributions vs exchange transactions:

Transaction is indicative of an exchange transaction if:

- The expressed intent of the recipient and resource provider is to exchange resources for goods or services that are of commensurate value

- The recipient and resource provider agree on an amount of transferred assets in exchange for goods or services of commensurate value

- Penalties as a result of failure to comply with terms of the agreement can exceed the amount originally provided by the resource provider

Transaction is indicative of a contribution if:

- The recipient has no intent to provide goods or service of commensurate value to the resource provider

- The resource provider has full discretion in determining the amount of transferred assets

- Penalties as a result of failure to comply with terms of the agreement are limited to the amount of assets or services already provided and the return of unspent amounts

This ASU does not apply to transfers of assets (typically from a governmental entity) that relate to an existing exchange transaction between the recipient and an identified customer. Common examples would be Medicare payments or government tuition assistance payments. In these situations, other guidance would apply (such as Topic 606).

Effective Dates for Resource Recipients: For public companies and not-for-profit organizations that have issued securities that are traded on an exchange or over-the-counter market, this ASU is effective for annual reporting periods beginning after June 15, 2018. For other organizations, this ASU is effective for annual reporting periods beginning after December 15, 2018. Early adoption is permitted.

Effective Dates for Resource Providers: For public companies and not-for-profit organizations that have issued securities that are traded on an exchange or over-the-counter market, this ASU is effective for annual reporting periods beginning after December 15, 2018. For other organizations, this ASU is effective for annual reporting periods beginning after December 15, 2019. Early adoption is permitted.

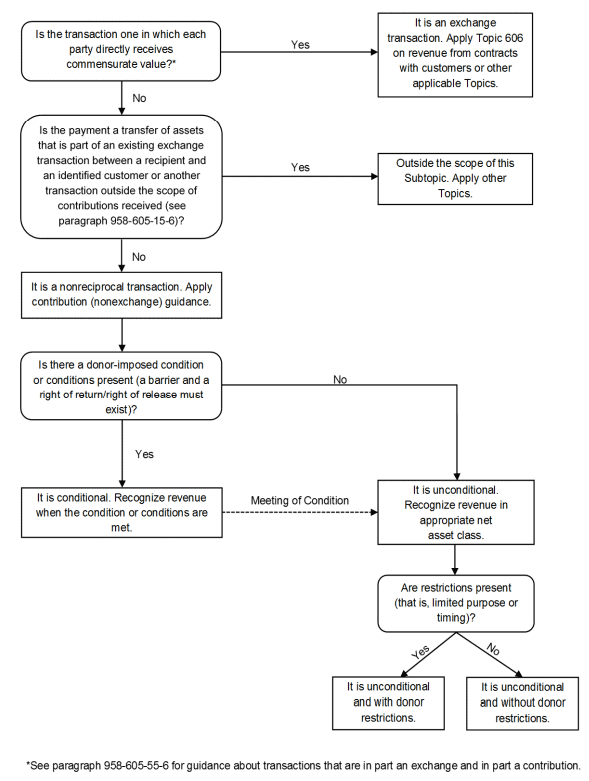

Below is a helpful diagram from the implementation guidance in ASU 2018-08. Be sure to read our next blog, “Accounting for Grants and Contributions (ASU 2018-08) – Part 2,” for detailed guidance regarding conditional and nonconditional contributions.

Photo by Amaury Henderick (License)